1 – Tunisia: Competitive but Underperforming on Global

Global Context and Tunisia’s Modest Role

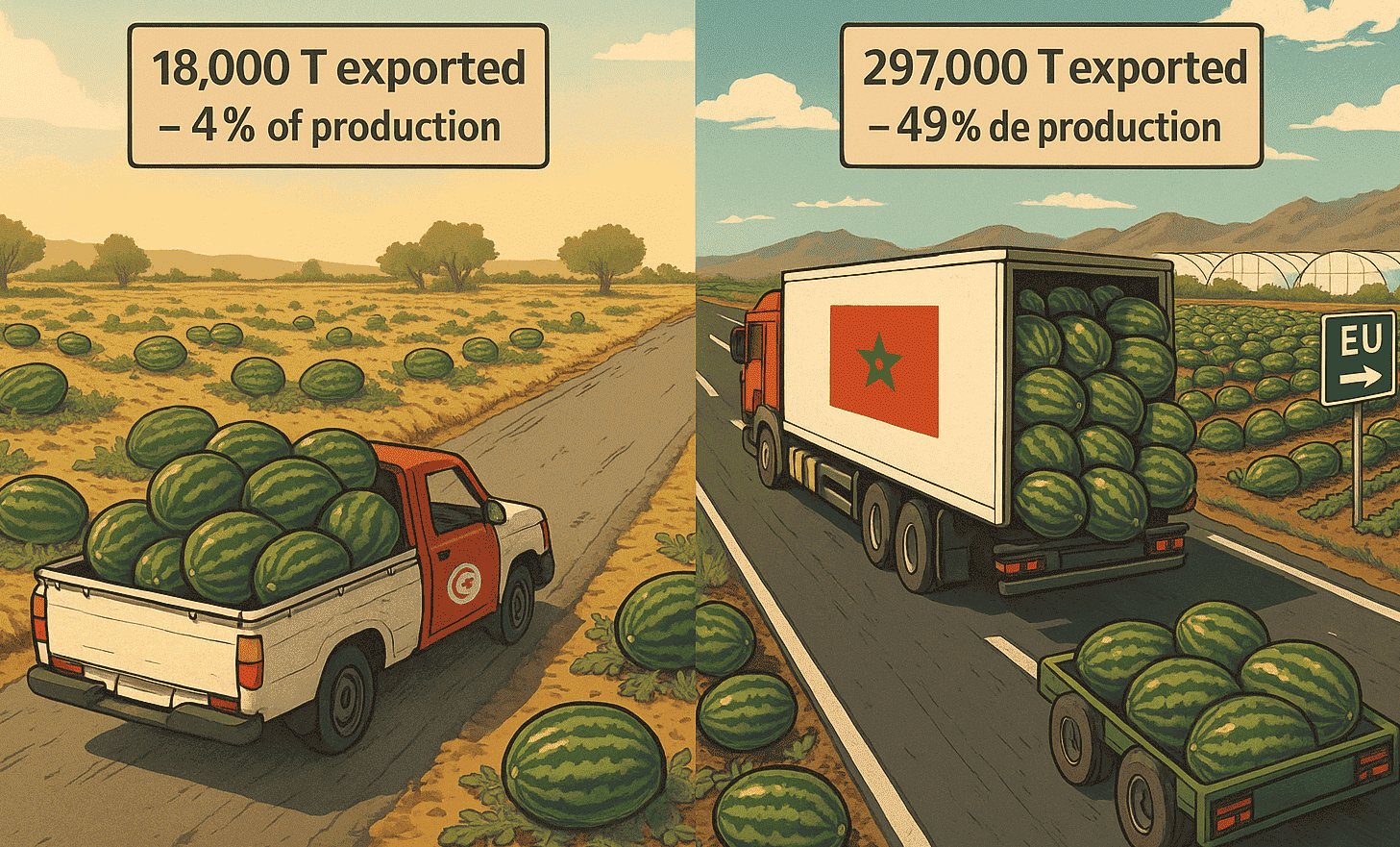

Although global watermelon production reached 100 million tons in 2022, Tunisia remains a minor player in export markets. Ranked 25th in global production with around 525,000 tons annually, Tunisia only exported 18,333 tons in 2022—representing just 4% of its production.

Its main customer is Libya, a highly volatile partner. In contrast, exports to high-value markets like France, Germany, the UK, and the Netherlands remain small and inconsistent.

Price Competitiveness, But a Revenue Gap

Tunisia’s average export unit value (FOB) was 368 USD/ton in 2022, compared to an average of 524 USD/ton for European markets.

A striking comparison:

-

Tunisia exported 12,569 T to Libya, generating $3.1 million.

-

In contrast, exports to France, UK, Germany, and the Netherlands combined only totaled 5,010 T, yet generated $3.05 million.

➤ Lower volumes, similar revenues: the EU pays far more per ton.

Priority Markets Identified

Based on import volume, price, growth trends, and access:

-

France – growing import demand, trade ties with Tunisia.

-

UK – premium prices, openness to new suppliers.

-

Netherlands – European hub, re-export leader.

-

Germany – large-scale importer with summer supply gaps.

Tunisia ranks among the most price-competitive suppliers during summer, especially in August.

2 – Morocco: Turning Potential into Performance

Tunisia vs Morocco: Key Metrics

Here is a clear comparison between both countries:

| Indicator (2022) | Tunisia | Morocco |

|---|---|---|

| Production (tons) | 450,000 | 602,950 |

| Export volume (tons) | 18,333 | 297,012 |

| Share of production exported | 4% | 49% |

| Global export ranking | 27th | 4th |

| Average export unit value | 368 USD/ton | 667 USD/ton |

What Gives Morocco the Edge?

-

Zero tariffs to the EU thanks to a free trade agreement (vs. partial access for Tunisia).

-

Advanced logistics & cold chain (Agadir, Tanger Med).

-

Strong institutional support (certifications, trade missions, branding).

-

Established commercial presence in Europe (top supplier to France).

-

Season extension strategies using climate zones and smart farming.

Lessons Tunisia Could Apply

-

Target competitive seasonal windows (ex: August).

-

Structure a coordinated export offer (consistency, volume, certifications).

-

Focus on product positioning (e.g. dryland farming, sweet varieties, local terroir).

-

Engage in joint promotion across producer groups.

Conclusion

Tunisia has what it takes to perform: land, climate, know-how, and proximity to Europe. Yet it lags behind due to fragmented efforts and lack of market structuring. Morocco, on the other hand, demonstrates what can be achieved with strategy, support, and branding.

➤ It’s not too late for Tunisia to turn the tide—but it requires coordination, investment, and vision.